When 25+ foreign nations simultaneously suspended postal delivery services to the United States effective August 29, 2025, sophisticated risk managers recognized this wasn't just a logistics inconvenience—it was a $800+ billion supply chain disruption that exposed fundamental vulnerabilities in global trade infrastructure. For businesses that understand the strategic value of proactive risk financing, this crisis presents a compelling case for comprehensive captive insurance solutions.

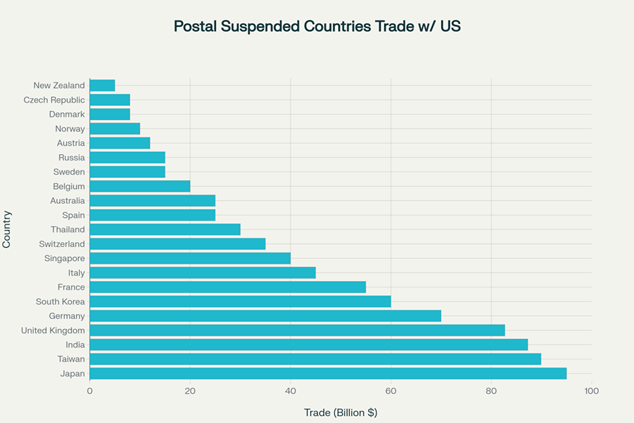

The elimination of the de minimis exemption has created an unprecedented challenge affecting major trading partners across three continents. Over 25 countries—including economic powerhouses like Germany ($70B annual trade), Japan ($95B), India ($87.28B), and the United Kingdom ($82.71B)—have indefinitely suspended small-package postal deliveries to avoid regulatory compliance burdens.

This isn't a temporary shipping delay; it's a fundamental restructuring of international commerce affecting 1.36 billion packages annually with collective value exceeding $64.6 billion. The ripple effects extend far beyond immediate shipping costs, creating cascading risks throughout global supply chains that traditional insurance markets struggle to address effectively.

European Trading Partners: United Kingdom, Germany, France, Italy, Spain, Belgium, Austria, Denmark, Sweden, Norway, Switzerland, Czech Republic

Asian Economic Centers: Japan, India, Singapore, South Korea, Taiwan, Thailand

Pacific Region: Australia, New Zealand

Additional Markets: Russia and other emerging economies

The postal delivery suspensions disproportionately affect sectors that have built business models around small-package international shipping. Forward-thinking risk managers are recognizing these exposures as prime candidates for captive insurance solutions that commercial markets cannot adequately address.

The regulatory framework changes underlying these postal suspensions have created specific administrative and compliance risks that represent significant captive insurance opportunities.

Duty and Tariff Compliance Exposures

The elimination of de minimis exemptions means every package now faces duty assessments ranging from $80-200 per item. This creates several potentially insurable exposures:

International Trade Credit Risks

The postal delivery suspensions have significantly altered international payment and delivery terms, creating enhanced opportunities for captive-based trade credit insurance programs. Organizations with existing captives can efficiently add trade credit coverage to diversify their risk portfolios while addressing specific exposures created by the current disruption.

Strategic Trade Credit Applications:

The Strategic Imperative: Transform Risk into Advantage

The foreign postal delivery suspensions represent more than a temporary disruption—they signal a fundamental shift in global trade regulation and supply chain risk management requirements. Organizations that recognize this crisis as an opportunity to implement sophisticated risk financing solutions through captive insurance will emerge stronger and more resilient.

Key Strategic Actions:

The postal delivery crisis has created a once-in-a-generation opportunity to transform traditional supply chain risk management approaches through strategic captive insurance implementation. Organizations that act decisively to capture this opportunity will build lasting competitive advantages while others struggle to adapt to the new risk landscape.

For sophisticated risk managers, the question isn't whether to implement captive solutions for supply chain risks—it's how quickly they can deploy these capabilities to turn crisis into competitive advantage. The disruption has already begun; the strategic response determines whether organizations emerge stronger or simply survive the transformation of global commerce.

Contact Captives Insure to explore how comprehensive captive insurance solutions can transform your supply chain risk management challenges into sustainable competitive advantages. Our award-winning team provides the expertise and market access necessary to implement captive programs that address the complex risks created by the current global trade disruption. Read a similar case study where a strategic international trade credit policy was implemented here.