This guide explores three industry-leading structures—Group Captives, Cell Captives, and Pure (Single Parent) Captives—showcasing their operational, financial, and strategic nuances. While each structure has their place, this article will outline the pros and cons of each, and what makes the most sense for your business.

Why Captives Matter

Captives are not just an alternative—they represent a strategic leap. The right captive arrangement transforms traditional insurance from a sunk cost into a profit-generating asset. With the expertise and infrastructure provided by Captives.Insure, clients can harness turn-key AM Best rated solutions while retaining vital commissions and maximizing account longevity. Every organization’s risk profile is unique, and our consultative process ensures a seamless transition from standard market coverage to tailored captive programs.

Group Captives: Shared Success and Collective Accountability

Group captives unite multiple organizations under a single risk pool, spreading both premiums and losses across the membership base. This structure appeals to businesses seeking:

While the group model provides economies of scale and fosters favorable loss control through collective management, members forfeit autonomy in return for predictable costs and community oversight. For many mid-sized companies, group captives offer a practical gateway to self-insurance without the risks—and rewards—of full independence.

Cell Captives: Flexible, Fast, Real Control

Cell captives (sometimes “rent-a-captives” or “protected cell companies”) revolutionize access by ring-fencing each participant’s assets, liabilities, and claims. Key advantages include:

Cell captives benefit organizations that want the cost savings and customization of a captive without bearing the full administrative and regulatory burden of pure captives. Each cell operates independently within the sponsor’s core, meaning third-party performance or stability does not interrupt your insurance program. This structure streamlines the launch process and reduces frictional costs, making it an ideal entry for growing firms, niche programs, or businesses with unique risk exposures.

Pure (Single Parent) Captives: Total Authority and Customization

A pure captive is synonymous with autonomy. Owned and controlled by a single entity (or closely aligned affiliates), the pure captive structure delivers:

Pure captives offer unmatched insurance customization—similar to cell captives, pure captives also offer the ability to choose 100% of their service providers and selection of domicile.

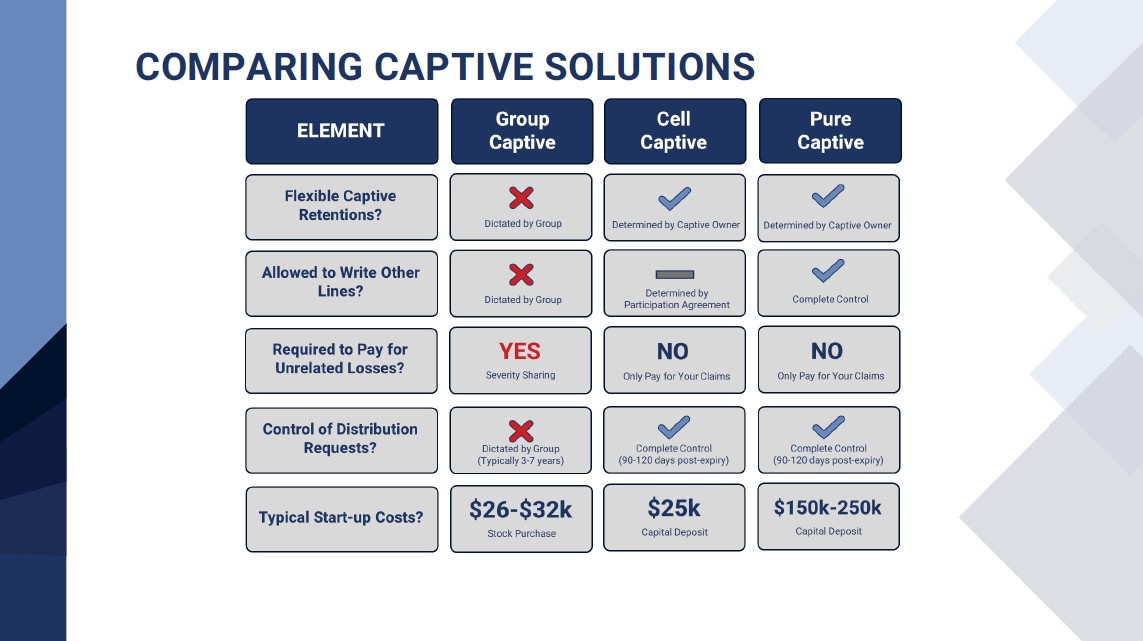

Visual Comparison: Key Distinctions

Formation and Operational Insights

Forming a captive begins with a feasibility study—to assess whether your risk profile and capital base fit the chosen structure. At Captives.Insure, the initial viability evaluation is complimentary for prospective clients. Once viability is affirmed, we coordinate all stakeholders (actuarial, legal, audit, and management teams) to deliver a turnkey experience—aligning underwriting, financial projections, and business planning published for regulatory approval purposes.

Selecting a domicile, developing a robust business plan, capitalizing the entity, and ensuring ongoing compliance are essential milestones. Our team streamlines each phase, keeping regulatory, tax, and operational complexities at bay. Regardless of cell or single parent, our solutions are built to navigate these differences with confidence.

Tailoring Your Captive: Strategic Considerations

Choosing between group, cell, and pure captives depends on several criteria:

Large enterprises often gravitate toward pure captives for customization and strategic optimization. Mid-sized and rapidly scaling firms find cell structures appealing for speed and efficiency. Smaller organizations seeking predictability and cost-sharing favor group captives as a stepping stone to broader captive participation.

Empowering Brokers and Managers

With Captives.Insure, brokers and captive managers benefit from our underwriting authority, broader coverage options, and seamless integration of AM Best rated solutions. Our open programs allow you to win new business, retain key accounts, and preserve commission structure, all without forcing disruptive management changes. Clients and intermediaries gain from the confidence, transparency, and scalability inherent in our methodology.

Captive insurance, when expertly guided and customized to fit the client’s risk and business objectives, can deliver transformative value—turning insurance costs into retained capital and future profit. Captives.Insure stands ready to build, and optimize your program from concept to operation.

For those ready to take control, explore our programs, and begin the captive journey, connect with our team today and unlock the full potential of captive insurance.