The United Kingdom is actively positioning itself to become a leading domicile for captive insurance, a move that could have significant implications for both UK and US markets. Recent government initiatives, including a three-month consultation on a dedicated regulatory regime for captives, signal a shift toward making the UK a more attractive and competitive environment for captive insurance companies. The United States currently maintains commanding leadership in the global captive insurance market, with approximately 55% market share representing roughly $87.5 billion in premium volume as of 2024. This dominance is concentrated among several key domiciles, with Vermont leading globally, followed by other significant players including Utah , Tennessee, and North Carolina, and others.

Regulatory Reform: The UK government is considering reforms to create a proportionate, business-friendly regulatory framework tailored to the lower-risk nature of captives. This would address the current situation where captives face the same stringent requirements as traditional insurers, prompting many UK companies to domicile their captives offshore.

Industry Support: The initiative has garnered strong support from industry bodies, brokers, and underwriters, who see it as an opportunity to reinforce London’s status as a global insurance hub and to retain more insurance activity onshore.

Protected Cell Companies (PCCs): The proposed use of PCCs could lower barriers to entry, making captive solutions more accessible to smaller businesses and broadening the UK’s appeal as a captive domicile.

Competitive Pressure: The UK’s move to establish a robust captive regime could increase competition for US domiciles, especially as US companies and multinationals may consider the UK for its proximity to the London insurance market and its global reinsurance expertise.

Regulatory Benchmarking: The UK is likely to look to established US and European captive frameworks for best practices, potentially raising the bar for regulatory standards and innovation in the captive sector globally.

Market Opportunities: A successful UK regime could attract new lines of business, including cyber, supply chain, and reputational risks, and may prompt US-based captives to consider redomiciling or expanding into the UK.

Brexit Complications: The loss of passporting rights into the European Economic Area means UK-based captives may be better suited for reinsurance rather than direct writing across multiple countries, which could limit their scope compared to US or other European domiciles.

Implementation Hurdles: The effectiveness of the UK’s new regime will depend on the speed and practicality of regulatory changes, as well as the ability to balance robust oversight with business-friendly policies.

The UK’s efforts to establish itself as a premier captive insurance domicile represent a pivotal moment for the global captive market. If implemented effectively, these reforms could reshape the competitive landscape, offering new opportunities and challenges for US-based captives and the broader risk management community.

Current US Market Dominance and Structure

The United States currently maintains commanding leadership in the global captive insurance market, with approximately 55% market share representing roughly $87.5 billion in premium volume as of 2024. This dominance is concentrated among several key domiciles, with Vermont leading globally, followed by other significant players including Utah , Tennessee, and North Carolina, and others.

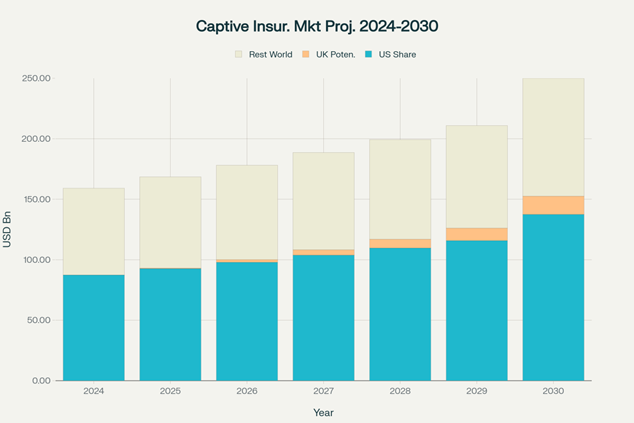

Global Captive Insurance Market Projection: US vs UK Market Share (2024-2030)

The US captive market demonstrated remarkable resilience in 2024, with Vermont adding 41 new captives and experiencing 6% premium growth across Marsh-managed captives. The total US captive population is estimated at approximately 4,400 entities (not including cells), collectively writing $35-40 billion in annual premiums.

Conservative Scenario (3% UK Market Share by 2030)

In this scenario, the UK captures $7.5 billion of the global market, representing a 1% reduction in US market share to 54%. This would primarily affect smaller US domiciles and newer formations, with established players like Vermont and Delaware maintaining their competitive positions.

Moderate Scenario (7% UK Market Share by 2030)

Under moderate adoption, the UK could achieve $17.5 billion in market value, reducing US market share to 52% with a corresponding $7.5 billion impact on US premium volume. This scenario would likely trigger enhanced competitive responses from US domiciles, including regulatory reforms and fee restructuring.

Aggressive Scenario (12% UK Market Share by 2030)

The most challenging scenario for US domiciles would see the UK capturing $30 billion in market value, reducing US share to 50% and creating a $12.5 billion competitive impact. This scenario would necessitate significant strategic adaptations across US domiciles.

Regulatory Competitiveness Pressures

The UK's commitment to proportionate regulation with lower capital requirements, faster authorization processes, and reduced reporting obligations will create pressure on US domiciles to enhance their competitive positioning. States like Vermont (with their current $250,000 minimum capital requirement and 3-6 month formation timelines) may face pressure to become more competitive with the UK's projected 6-10 week authorization process.

Protected Cell Company Competition

The UK's emphasis on Protected Cell Company (PCC) structures represents a particular competitive threat to US domiciles. PCCs can reduce operating costs by up to 50% compared to single-parent captives and enable formation in days rather than months. While some US domiciles offer similar structures (Tennessee's sponsored captives, Delaware's series LLCs), the UK's comprehensive PCC framework may attract cost-conscious formations.

US domiciles are likely to respond through several strategic initiatives:

Enhanced Service Offerings: Greater emphasis on value-added services including sophisticated risk analytics, integrated claims management, and expanded reinsurance placement capabilities.

Cost Structure Optimization: Competitive pressure will drive fee reductions and streamlined processes, particularly for smaller captives where the UK regime may offer cost advantages.

Regulatory Innovation: US domiciles may accelerate legislative modernization to maintain competitive advantages, similar to Vermont's recent H.659 amendments eliminating redundancies in the Captive Insurance Act.

Cross-Border Captive Strategies

The UK regime creates new opportunities for US companies to establish cross-border captive structures that leverage both US and UK regulatory frameworks. This could be particularly attractive for multinational corporations seeking to optimize their global risk management strategies.

London Market Access

US companies establishing UK captives would gain direct access to the London reinsurance market, potentially reducing transaction costs and enhancing reinsurance placement efficiency. The London Market Group estimates this proximity advantage could generate £153 million in annual value for reshored captives.

Regulatory Arbitrage Opportunities

The UK's differentiated regulatory approach for direct-writing versus reinsurance captives may create opportunities for US companies to optimize their captive structures based on specific risk profiles and regulatory requirements.

Cost Structure Analysis

Formation and Operating Cost Implications

The UK regime is projected to offer formation costs of $60,000-120,000 compared to the US range of $75,000-150,000, with annual operating costs of $150,000-300,000 versus $200,000-400,000 in the US. These cost advantages may be particularly attractive to mid-market companies that have historically found captive insurance economically challenging.

Minimum Capital Requirements

The UK's proposed £100,000-200,000 minimum capital requirement compares favorably to the US standard of $250,000, potentially making captive insurance accessible to smaller organizations. This could expand the addressable market beyond traditional Fortune 500 companies to include middle-market enterprises.

Historical Migration Patterns

Analysis of captive domicile migration reveals that vwey few captives actually undertake a redomesitcation, suggesting that established captives are unlikely to relocate solely based on regulatory advantages. However, the UK regime may attract new formations that would otherwise have been established in US domiciles. The UK regime may particularly appeal to UK-based companies that have historically established captives in offshore domiciles due to regulatory constraints. An estimated 500 UK-associated captives are currently domiciled in jurisdictions like Guernsey, Bermuda, and the Isle of Man.

Market Maturation Effects

As the UK captive market matures, it may develop specialized expertise in emerging risk categories such as cyber liability, climate risk, and ESG-related exposures. This specialization could create competitive advantages that extend beyond regulatory arbitrage. The UK's approach to proportionate captive regulation may influence regulatory development in other jurisdictions, potentially creating pressure for global harmonization of captive regulatory standards.

Recommendations for US Market Participants

For US Domiciles

For US Companies

Conclusion

The UK's captive insurance regime represents a fundamental shift in the global competitive landscape that will require strategic adaptation from US market participants. While the immediate impact may be limited due to the natural inertia of established captive structures, the long-term implications are significant. US domiciles that proactively enhance their competitive positioning through regulatory modernization, cost optimization, and service innovation will be best positioned to maintain market leadership. Conversely, US companies that strategically leverage the UK regime's opportunities may achieve enhanced risk management capabilities and cost efficiencies.

The projected market dynamics suggest that rather than a zero-sum competition, the UK regime may contribute to overall market expansion by making captive insurance more accessible to mid-market companies. However, US domiciles cannot afford complacency, as the UK's comprehensive approach to captive regulation, combined with London's established insurance infrastructure, creates a formidable competitive challenge that will reshape the global captive insurance landscape through 2030 and beyond.